We meet many recruitment leaders whose senior executives have recently paid tens of thousands for consultancy to guide their international recruitment strategies and plans.

There’s of course nothing inherently wrong with consultancy, but expect the outputs to tell the reader to do things those consultants were doing five or ten years ago as practitioners (if they've done it at all), since a consultant's job is to advise & guide based on experience and observation rather than to create new ways of tackling problems.

And the sector is unrecognisable today vs. five years ago.

For innovation, providers must look beyond high-cost consultancy. Senior leaders should resist seeking the warm hug that comes with paying for a report from a well-known brand. Yes, nobody lost their job for buying IBM, but plenty lose them through failure to change.

Here are 6 things most providers cannot do today that all need to be doing.

1. Capture supply of load before it is routed to competitors

Consultants will tell providers to increase their in-country presence in support of more offline recruitment efforts, build CX/technology teams (I’ve built several - they’re important, but merely hygiene factors today), and redesign product ranges. But they say nothing about changing the way the load is captured because they don’t know about digital terms agreement either. They’re advising on faster horses when providers need cars.

And cars do exist ↓

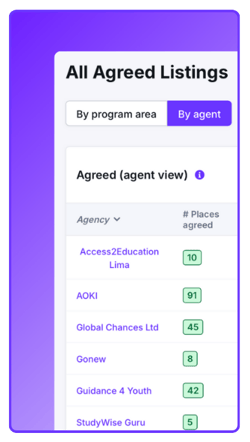

Here's how it's done: Stop fighting fair, i.e. recruiting in the same way & at the same time as your competitors. Get agents to commit to delivering specific numbers of students for certain programs and intakes, as set by you. De-risk a portion of your supply and cut panicked spends on activity, travel, bonus, etc.

2. See what it should cost today

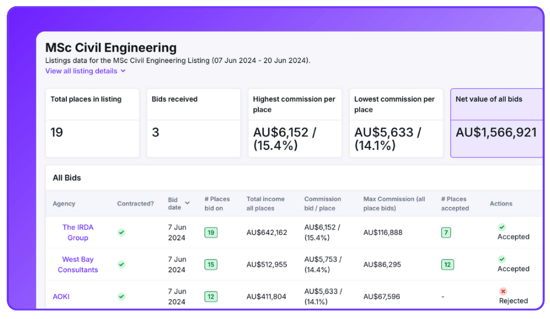

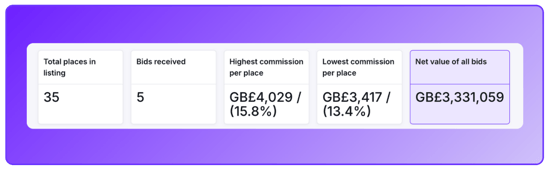

When a provider has set commission terms in stone it surrenders the opportunity to calibrate commission by market or by program/course. Want to do as the consultants advise and enter an emerging market like Vietnam, or Zimbabwe? What commission do you offer to agents there? Almost every provider we speak to just goes to their base commission paid to existing agent partners. Why?? And how many of a provider’s current agents offer to place students for less than their contracted minimum? Nil. That’s because there’s zero price marketisation on commission in the way providers currently operate - $Billions spent every year without being directly contested. What could you save? 👇

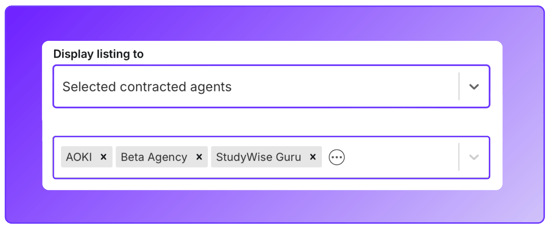

Here's how it's done: Point listings for your programs and courses at agents in markets you may be considering entering, or at agents in your primary markets who may have better supply of students than your existing agents. Invite commission offers. Proceed to due diligence if interested, reject offers if not. No getting on planes, no 12 month lead times. All instant, from your desk.

3. Drive down sales costs whilst driving up load & diversity

Providers cannot do this today because their supply is passive and most of their indicators are lagging, so controlling pipeline becomes nigh on impossible. Higher-paid agents therefore are incentivised to over-fill and this keeps average acquisition costs artificially high. It also leads to overpayment for scarce and abundant student types.

Here's how it's done: Target your agents that deliver you the least load with more placement opportunities, playing with the commission value delta to both drive increases in recruitment and cut cost of sales. This can only be done where you constrain your pipeline (see #6 ↓) - not possible in a passive supply model today. Feezy lets you 'tag' or 'group' your agents by similar characteristics so you can work on a range of optimisation data points with just a few minutes of admin.

4. Improve all agents' performance

The number one place for optimising for any provider that currently runs an agent partner pool.

Here's how it's done: Stop letting under-performers hide in the shadows of multi-year siloed terms agreements. Point listings at these and track offers to recruit (or not) and fulfilment to targets in real time. Churn poor agents for better agents who will work for you (see #2 above).

5. Track & report on live agent performance by market

Stop relying on lagging indicators like forecast conversion that so often disappoint and come with zero hard assurances.

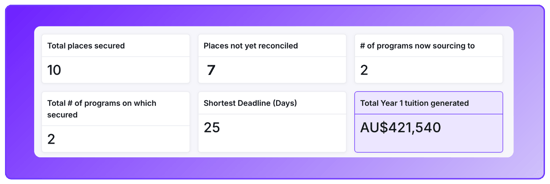

Here's how it's done: Show senior leadership what’s been secured that week. See number of days remaining for fulfilment to your deadlines, and responsively react to undersupply in course areas to capture required load. No more panicked recruitment-planning meetings in the lead up to enrolment deadlines.

6. Control your pipeline

Very few providers outside the world top 20 universities control their pipelines today. All a provider’s agents can recruit to all or almost all its courses and programs at any time. (Again, worth asking yourself why you allow this.) This causes problems like oversupply / undersupply in some areas, poor conversion, and non diverse classrooms.

Here's how it's done: Decide which agents can deliver what recruitment load to your programs and courses well in advance. This can be a tiny proportion of total places, or larger. It is done alongside your existing passive supply model and so can diversify classes, cut costs, or improve visa compliance rates.

***

Unsure if this way is for you? Ask yourself this: is the set of tactics you are deploying today working? The answer is “no” if you are either spending more than you were previously and/or only maintaining your intake sizes. Agent commission terms underpin everything your team does - have you optimised yours?