The critical need for universities and colleges in at least the UK, Australia, and Canada to achieve financial sustainability means really two things for international recruiters:

-

Recruit more international students, potentially as demand reduces; and

-

Cut the cost of acquiring each student.

And for agents it means gaining an advantage over often established players with greater prospect reach, deeper pockets, and broader partner networks, since these large operators often earn higher average commission rates.

When both providers and agents are able to compete more freely and directly, the sector gets healthier and each side benefits.

A Common Challenge

In 2024, every provider we’ve engaged has come to us with similar unoptimised agent performance metrics.

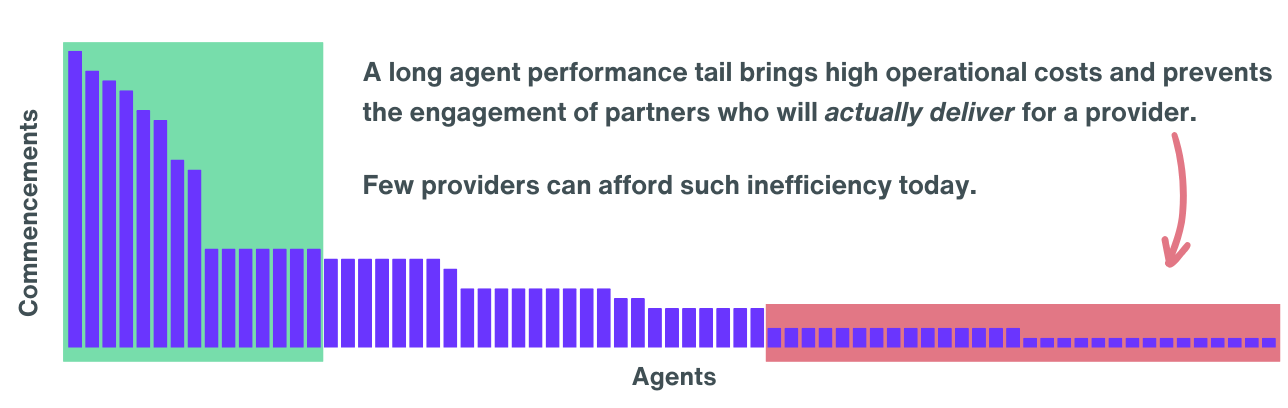

Typically, it looks something like this, with a fifth of partner agencies supplying four-fifths of commencing load. This structural inefficiency will be a focal point at The PIE Live APAC during our session, ‘Disrupting Agent Commission Agreements’.

For instance, one UK provider managing agreements with over 300 agents had not previously reviewed the performance of all its partners, instead focusing on the 35 or so that delivered most of its load. It spends about £10M a year on commission (2.7% of its total annual expenditure), plus millions more on associated OpEx. Material sums.

A Canadian provider with about 2000 directly-contracted agents found that approximately 100 of them were responsible for about 90% of student enrolments.

Two questions arise: what purpose do the remaining 1900 agents serve, and what are the costs - incl. opportunity costs - associated with maintaining these all-but-defunct relationships?

There’s often no greater bang-for-buck potential for optimising outcomes than working to improve existing contracted agents’ outputs; failure to do so means more high-cost ‘busy work’ whilst dozens (or hundreds) of agent partners deliver better outcomes to a provider’s competitors.

Even a modest redistribution of a university’s millions in commission spend - from top-earning agents to traditionally lower-cost-per-acquisition agents - can yield substantial increases in student commencements while reducing acquisition costs.

See here how it can work for a provider with an admittedly large commission delta (11% from highest to lowest earning agent). The gap = the opportunity, and for most providers today there’s no way to exploit this at scale.

-2.png?width=700&height=239&name=Pie%20Live%2028%20Jul24%20(1)-2.png)

Why isn’t it standard practice to optimise here?

Because it’s hard to do this well today. It's time-consuming. And, since it takes a pivot from normal BAU even as teams in multiple markets are trimmed down to reduce costs further, it means saying no to in-flight work to get it done. Plus, it’s usually more miss than hit in terms of impact. Lots of promises to improve, but no skin in the game to back it. The fixed terms approach to contracting causes this.

This is why it’s so important to revise how terms are agreed. Or at least to have another option vs the norm. Because lifting performance of an agent on a fixed commission and with substantial time remaining on their contract is hard. The incentives to change just don’t exist today.